Timeshare Cancellation Attorney Help

Our attorneys can help protect you and end your abusive timeshare contract. End your timeshare problems now! Terminating a timeshare contract can have legal and financial consequences, and it is important to carefully consider your options and consult with an attorney before taking any action.

- Stop Paying For A Timeshare That You Are Unable To Use

- Stop The Endless Cycle of Monthly Payments & Annual Maintenance Fees

- Stop Your Children From Inheriting Your Timeshare Nightmare

- Stop Your Timeshare Obligation From Hurting Your Credit Score

Contents

- 0.1 Timeshare Cancellation Attorney in Texas

- 0.2 Possible ways to terminate a timeshare

- 0.3 A Deed-Back Program

- 0.4 Reasons to Terminate a Timeshare

- 0.5 Why timeshare feels like entrapment?

- 0.6 Common penalties for timeshare termination

- 0.7 DEFENSES TO ENFORCEMENT OF A TIMESHARE CONTRACT

- 0.8 DECEPTIVE TRADE PRACTICES AND THE EFFECT OF CONTRACTUAL DISCLAIMERS

- 0.9 Can I get a refund for my timeshare?

- 0.10 Timeshare Rescission

- 0.11 Selling the Timeshare

- 0.12 How To Get Rid of A Timeshare If It Won’t Sell

- 1 Timeshare and Divorce

- 2 Why Quickclaims Deed is not an Answer to Timeshare Exit?

It’s important to distinguish between cancellation and exit when it comes to timeshares. Cancellation usually refers to the specific period of time after purchasing a timeshare during which you can legally cancel the contract. Exit, on the other hand, is the process of terminating your timeshare after the cancellation window has closed. A timeshare cancellation attorney can assist you in reviewing the terms of your contract and helping you cancel your timeshare during the rescission period. If the rescission period has already passed, a timeshare exit attorney can help you navigate the process of terminating your timeshare.

- Sell the timeshare: One option is to sell the timeshare to someone else. You can either sell it on the open market or work with a timeshare resale company. Keep in mind that it can be difficult to sell a timeshare, and you may need to lower your asking price significantly to find a buyer.

- Donate the timeshare: You may be able to donate the timeshare to a charity, which can then sell or rent it to generate funds. However, be aware that the tax benefits of timeshare donations are limited, and you may not be able to claim a deduction for the full value of the timeshare.

- Negotiate with the timeshare company: Some timeshare companies may be willing to negotiate a termination or buyback of the timeshare, although this is rare. If you are struggling to make payments or are facing other financial hardship, you may be able to work out a deal with the company.

- A deed-back program for a timeshare is an arrangement where the timeshare owner voluntarily transfers ownership of their timeshare back to the resort or management company. This is often an alternative to selling the timeshare on the secondary market or defaulting on maintenance fees, which could lead to foreclosure.

- Hire an attorney to help exit timeshare: An attorney can help people terminate timeshare contracts. They may also assist with negotiating with the timeshare company, finding a buyer, or helping you legally terminate the contract.

- Consult with a lawyer: If you believe that the timeshare company engaged in fraudulent or deceptive practices when selling you the timeshare, you may be able to terminate the contract through legal action.

- Seek legal advice: If you are having trouble terminating your timeshare and have exhausted all other options, you may want to consider seeking legal advice. An attorney can review your timeshare contract and help you determine your rights and options for terminating the contract.

- Default on payments: While this is not recommended, if you are unable to sell or terminate your timeshare through other means, you may choose to stop making payments and allow the timeshare to go into default. This can have serious consequences for your credit score and may result in the timeshare company pursuing legal action against you to collect the debt.

A Deed-Back Program

A deed-back program for a timeshare is an arrangement where the timeshare owner voluntarily transfers ownership of their timeshare back to the resort or management company.

In a deed-back arrangement, the timeshare owner usually must be current on all fees, including maintenance and any loans associated with the timeshare. The specifics of the deed-back program can vary widely from company to company. Some companies might offer this program for free or a nominal fee, while others may charge substantial amounts.

This is not the same as a quick claim deed; and the cost to the timeshare owner could be several thousand dollars, payable to the timeshare company, in addition to your attorney’s fees.

The process generally involves signing various legal documents, including the deed itself, which transfers ownership of the property back to the resort or management company. It’s crucial to understand the terms of the deed-back agreement, as you may still be responsible for certain fees or conditions.

Before engaging in a deed-back program, it’s advisable to read all the terms and conditions carefully and consult with an attorney experienced in real estate and timeshare issues. You should understand what you’re agreeing to, including any future financial obligations or limitations. Given the financial implications, it’s vital to consult with professionals to ensure that a deed-back is the most advantageous way for you to relinquish your timeshare.

There are many reasons why someone might want to terminate a timeshare, including:

- Financial burden: Timeshares can be expensive, with upfront costs, maintenance fees, and other associated costs. If you can no longer afford to pay for your timeshare, terminating the contract may be your best option.

- Unused or unwanted: If you find that you are not using your timeshare as much as you thought you would, or if you simply no longer want it, terminating the contract may be a good way to get out of it.

- Changes in lifestyle: Life circumstances can change over time, making a timeshare no longer a practical or desirable option. For example, if you have retired, you may find that you want to travel less and spend more time at home.

- Difficulty selling: If you have tried to sell your timeshare without success, or if you have found that the resale market is flooded with similar properties, terminating the contract may be a better option.

- Misrepresentation: If you feel that you were misled or deceived in the sales process, or if you feel that the timeshare company did not deliver on its promises, you may have grounds to terminate the contract.

Timeshares can often feel like entrapment for a number of reasons. Some of the most common reasons include:

- Long-term commitment: Many timeshare contracts require owners to commit to the property for several years, often with little or no opportunity to cancel or terminate the agreement.

- Limited flexibility: Owners of timeshares may have limited flexibility in terms of when and where they can use the property, which can make it difficult to plan vacations or travel.

- Maintenance fees: Timeshare owners are typically required to pay maintenance fees to cover the cost of upkeep and repairs for the property, even if they are unable to use the property for any given year.

- Difficulty selling: Timeshares can be difficult to sell or get rid of, which can leave owners feeling trapped or stuck with a property they no longer want or need.

These factors, among others, can contribute to the feeling of entrapment that many people experience with timeshares. It’s important to carefully consider the potential drawbacks and limitations of a timeshare before making a long-term commitment to the property.

The penalties for timeshare termination can vary depending on the specific terms of your timeshare contract, as well as the state laws where the timeshare is located. However, some common penalties that may be associated with terminating a timeshare contract include:

- Loss of money: You may lose some or all of the money that you paid upfront for the timeshare, as well as any maintenance fees or other costs associated with the property.

- Damage to credit score: Terminating a timeshare contract can have a negative impact on your credit score, as it may be considered a default on a loan or contract.

- Legal action: The timeshare company may pursue legal action against you to collect any outstanding debts or fees associated with the timeshare contract.

- Collection efforts: The timeshare company may use collection agencies or other means to attempt to collect any outstanding debts or fees.

It’s important to carefully review your timeshare contract before terminating it, and to understand the potential consequences and penalties. You may also want to consider seeking legal advice before taking any action.

DEFENSES TO ENFORCEMENT OF A TIMESHARE CONTRACT

Contractual defenses generally applicable to the enforceability of any contract will apply equally well in the context of timeshare law. However, due to the nature of timeshare sales, certain common complaints seem to arise time and again. These have primarily to do with the disparity in resources, bargaining power, and familiarity with the nuances of timeshare offerings typically characterizing these transactions. Collectively, these factors tend to create a recipe for abusive practices giving rise to the kinds of grievances so commonly heard. Thus, this article endeavors to set forth those defenses that most frequently occur in this arena.

1. Fraud-in-the-Inducement

Or “common law fraud”, this is technically, the intentional use of deceit, a trick or some dishonest means reasonably relied upon to deprive another of money, property or a legal right. This is by far the most common legal defense asserted to the enforcement of a timeshare sales contract. Falsehoods typically cited include statements that the timeshare is a ‘real estate investment’, that it ‘appreciates’ in value, that it is easily ‘resold’, that the seller has a ‘buy-back’ program, that it can be easily ‘sub-leased’ to defray the costs of ownership, and/or that it accords ‘exclusive’ access to a resort network. One cannot absolve himself of fraudulent conduct by inserting disclaimers or waivers in a contract, (Shelby Electric Company, Inc. v. Forbes, 205 S.W.3d 448, 455 (Tenn. Ct. App. 2005), as this would constitute an illegal provision, which is by definition unenforceable. (Scovill v. WSYX/ABC, Sinclair Broad. Grp., Inc., 425 F.3d 1012 (6th Cir. 2005).

2. Statutory Fraud

In many, if not all U.S. jurisdictions, the presence of common law fraud will dovetail into a cognizable statutory claim under the applicable state consumer protection statute, typically codified under as an “unfair deceptive sales practices act”, or the like. These will generally have provisions for the recovery of attorney fees and costs for a prevailing consumer, and even exemplary damages if willful misconduct is present.

3. Incapacity

Often, elderly consumers become the victims of unscrupulous conduct during timeshare sales. Particularly if the consumer has a documented medical condition involving dementia or any diagnosis giving rise to compromised faculties, this defense will preclude the enforcement of a contract where exploitation has occurred. Spahr v. Secco, 330 F.3d 1266 (10th Cir. 2003).

4. Duress or undue influence

If the consumer was pressured into signing the contract under duress or undue influence, such as through the use of high-pressure sales tactics or threats, this may be a defense to enforcement. Some examples specific to timeshare cases include situations where a consumer is taken to a remote place with no return transportation, where parents are separated from their children, and/or where the sales presentation becomes so protracted, confining, or overbearing that the consumer is willing to sign off on the documentation merely to escape the pressure of the situation.

5. Failure of Consideration

In the timeshare law milieu, this defense becomes applicable, particularly where the consumer derives no cognizable benefit from having signed the contract. Indeed, she may well be in a position less favorable than one who endeavors to make reservations anonymously, online, at resorts within the developer’s network. With astounding frequency, the unwitting new ‘member’ will find that she cannot book stays at preferred times and accommodations through the ‘membership’ portal, whereas a non-member booking through a third party such as Expedia or Priceline can. In other words, the timeshare discriminates against members in favor of non-members (who will presumably be forced to sit through a sales presentation, and unwittingly also then trapped into ‘membership’.)

By any reasonable standards, this is not merely a raw deal. The timeshare is literally a net liability. This is sometimes called ‘frustration of purpose’. Crown Ice Mach. Leasing Co. v. Sam Senter Farms, Inc., 174 So. 2d 614, 616 (Fla. Dist. Ct. App. 1965); Billian vs Mobil Corporation, 710 So.2d 984, 991 (Fla 4th DCA En banc 1998).

See, e.g., Cal. Civ. Code §§ 1770 through 1785. https://law.justia.com/codes/california/2010/civ/1770.html

6. Unconscionability

If the terms of the contract are so one-sided that they are unconscionable, such as by giving the timeshare company excessive control over the consumer’s use of the property, this may be a defense to enforcement.

7. Statute of limitations

If the timeshare company waited too long to file a lawsuit to enforce the contract, the consumer may be able to use the statute of limitations as a defense to enforcement.

DECEPTIVE TRADE PRACTICES AND THE EFFECT OF CONTRACTUAL DISCLAIMERS

Frequently in the service industries, particularly those involving the consuming public, merchants will endeavor to add disclaiming verbiage to boilerplate instruments in which the buyer ‘acknowledges’ not having been misled by certain – and often very specific – misrepresentations. This practice is especially true in timeshare sales, where false promises of certain kinds of benefits are common. Among these are assurances that the timeshare can be ‘easily resold’, that it’s a ‘real estate investment’, that it will ‘appreciate’ in value, and that the buyer can ‘rent out’ the interest in order to defray costs of ownership.

Of importance, the savvy timeshare developer will often characterize the disclaimer as an ‘acknowledgment’ that such promises were not made during a given sales presentation. In this fashion, the seller hopes to absolve itself of false promises in spite of their utterance by, in effect, rewriting history. Thus, they’re not endeavoring to disclaim fraud, rather they’re getting the buyer to acknowledge the lack of fraud to begin with, regardless of what was actually said.

Effective as a disclaimer clause may be to limit a contract right of action, it will not bar actions sounding in tort. Schroeder v. Hotel Commercial Co., 84 Wash. 685, 147 Pac. 417 (1915); Wells v. Walker, 109 Wash. 332, 186 Pac. 857 (1920). The underlying principle behind this rule might well be one of public policy. Courts have been reluctant to allow a party to a contract to completely disclaim all responsibility under any theory which the other party might advance. Consequently, it has long been the rule that although a vendor could bar a warranty action by disclaimer, an action based upon a fraudulent misrepresentation could not be so disclaimed. Wells at 337.

The existence of a written disclaimer is ineffective to negate fraud in the inducement Tinker v. De Maria Porsche Audi, Inc., 459 So.2d 487 (Fla. App. 3 Dist., 1984) review denied, 471 So.2d 43 (Fla. 1985). Neither can the parol evidence rule apply where there is an allegation of fraudulent inducement to a contract. Lou Bachrodt Chevrolet, Inc. v. Savage, 570 So. 2d 306, 308 (Fla. 4th DCA 1990). Moreover, “when fraud enters into a transaction to the extent of inducing a written contract, the parol evidence rule is not applicable” Marlite, Inc. v. Eckenrod case no. 10-23641-civ (S.D. Fla., 2012).

As a practice pointer, the consumer-plaintiff’s counsel will do well to characterize the cause of action as one sounding in tort rather than contract. Fraud-in-the-inducement, of course, will often be the tort of choice. Moreover, this cause of action also dovetails into a statutory cause of action based in the consumer protection statutes on the books of many states. Unlike the common-law cause, these will generally have more teeth to them, including provisions for the award of attorney fees and costs where the plaintiff prevails. Examples include Florida Statute Section §721. et seq., a timeshare-specific statute with consumer-protection features. In addition, most states will have a generic consumer protection statute such as Texas DTPA, or Fla. Stat. §501, et seq., which generally prohibit unfair and deceptive business practices. For a concise digest of these statutes on a state-by-state basis, a point of reference is NCLC’s 50 State Evaluation of Unfair Deceptive Practice Laws.

It is important to note that the specific defenses available will depend on the facts and circumstances of each case, as well as the applicable law in Texas. It is therefore recommended to seek the advice of an experienced attorney with knowledge of timeshare law in Texas to determine the best defense strategy for your particular situation.

Whether or not you can get a refund for money paid to a timeshare depends on a few factors, including the terms of your timeshare contract, the state where the timeshare is located, and the circumstances under which you want to cancel the timeshare.

In general, most timeshare contracts provide a rescission period, which is a period of time after signing the contract during which you can cancel the timeshare and receive a refund of any money you’ve paid. The length of the rescission period can vary by state, but it’s typically between three and 10 days. If you’re still within the rescission period, you may be able to cancel the timeshare and receive a full refund.

If you’re outside of the rescission period, your options for getting a refund are more limited. You may be able to negotiate a refund or partial refund directly with the timeshare company, but this can be difficult. Alternatively, you may need to pursue legal action, such as filing a lawsuit or working with a timeshare cancellation attorney, to try to get a refund.

It’s important to note that getting a refund for a timeshare can be challenging, and there’s no guarantee that you’ll be successful. It’s always best to carefully review your timeshare contract and explore your options as early as possible if you’re considering canceling your timeshare.

If you’d like to get rid of your timeshare, you’ve come to the right place. We help timeshare owners find the best option available to them to get out of their timeshare. Some timeshare resort developers will take your timeshare back if you simply ask them to do so, but others will not.

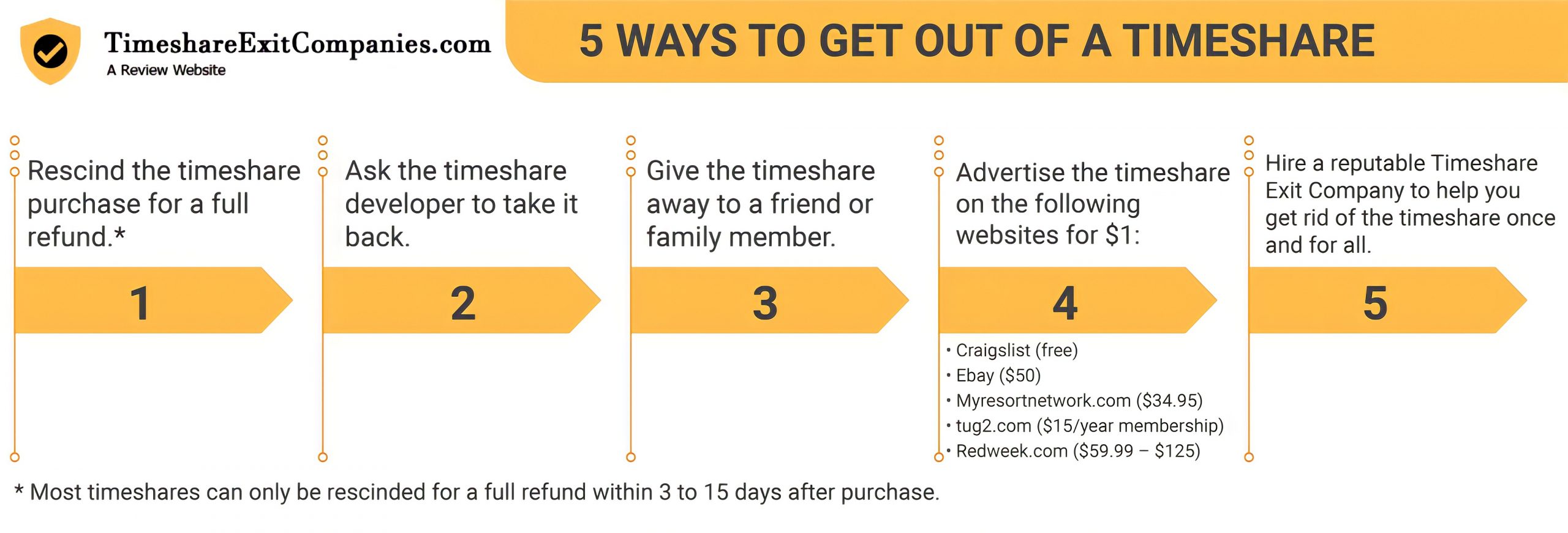

The process of getting rid of your timeshare can vary depending on the type of timeshare you own, its location, whether the timeshare is paid in full or not, and the date on which you originally purchased the timeshare. If you purchased the timeshare recently, like within the last week or two, it’s strongly encouraged that you look in to something called a rescission period.

Most states in the USA grant you the right to “rescind” your timeshare purchase within a certain number of days after purchase. Sometimes this time frame is as short as five days, so you’ll need to move quickly if you’d like to rescind.

Rescinding a timeshare means legally canceling the timeshare, no questions asked, for a full refund. In most states, resort developers are required by law to include instructions on how to rescind the timeshare within the documents you received when purchasing the timeshare.

In general, you’ll need to send the resort, via certified or registered mail, a letter stating that you’d like to rescind your purchase for a full refund. You will usually want to include your name and owner number if you have one.

Follow the instructions in the documents you received when you purchased the timeshare for exact instructions. The resort must comply with your request by law. Check with the state in which you purchased the timeshare to see if you’re still eligible for this timeshare cancellation option.

Rescission laws also exist in Mexico. Some islands in the Caribbean do not have rescission laws in place though.

Unfortunately, most of you reading this article likely don’t qualify for the state’s rescission option anymore. No worries! You still have options.

Despite what you may read online, it is not impossible to sell a timeshare. The following websites can help you advertise your timeshare for sale for free or for a low up-front fee:

- Craigslist

- Ebay ($50)

- Myresortnetwork.com ($34.95)

- tug2.com ($15/year membership)

- Redweek.com ($59.99 – $125)

We’d suggest signing up to all sites for a better chance of selling and offering to pay for the closing costs and transfer fees upon completion of the sale. Some owners even offer a $1,000 gift card along with the sale to help sweeten the deal.

Watch out for timeshare resale companies that want to charge a high up-front fee to sell your timeshare. Usually, these companies will charge a high up-front fee and then claim to “advertise” your timeshare on their website. Their high up-front fee is rarely a good value for the amount of exposure you will get on their website. You’ll likely be much better off using Craigslist, Ebay, Myresortnetwork.com, tug2.com and Redweek.com to advertise your timeshare for sale for a low fee or free.

Some things that will affect your probability of selling the timeshare are the type of timeshare you own, its location and whether the timeshare is paid in full. If you still owe on your timeshare, it’s going to be hard, if not impossible, to sell it someone else. If you own a desirable week at a desirable location such as Hawaii, you might have an easier time getting rid of it than say if you own at a resort in the middle of nowhere in Nebraska. The resort developer brand can also be a factor.

If rescinding the contract is out and you’re not able to sell, you’ll need to look into alternative options.

In matters involving timeshare payment liability, it’s crucial to understand that your marital decree and your contract with the timeshare company serve different legal purposes and impose different obligations.

1. Marital Decree: If your marital decree states that the opposing party is responsible for paying the timeshare, you may have legal recourse against them for not abiding by the decree. This could include bringing a contempt action against them or seeking damages in court. Should something happen to him, his estate may be liable for this debt, depending on the laws governing estate and probate in Texas.

2. Contract with Timeshare Company: However, understand that the marital decree’s terms are not binding on the timeshare company. From their perspective, both parties on the original contract are usually still liable for payments. If payments aren’t made, they can report to credit agencies, which is why you’ve received negative remarks on your credit report.

3. Both Parties Liable: To the timeshare company, both you and your ex-spouse are likely liable for the payments, despite what your marital decree says. Thus, it may be necessary to pay the company first to avoid further damage to your credit and then seek reimbursement from your ex-spouse or his estate.

4. Legal Options:

• Indemnification: One option could be to take your ex-spouse to court for indemnification for any amounts you’ve had to pay and any damages you’ve suffered (like credit damage).

• Deed Transfer or Sale: Another option could be to negotiate with your ex-spouse to have the timeshare deed transferred entirely to one party or to sell the timeshare and divide the proceeds or debts.

• Negotiation with Timeshare Company: Sometimes, timeshare companies are willing to negotiate payment terms or even a deed-back arrangement where you return the timeshare to the company, thereby minimizing your liabilities.

Using a quitclaim deed as a mechanism for exiting a timeshare is generally not recommended for several reasons, primarily because it doesn’t relieve the grantor—the person transferring the timeshare—of the financial obligations associated with the timeshare contract. Here are some points to consider:

Financial Obligations: Even if the property’s deed is transferred, the financial obligations, including loans, maintenance fees, and special assessments, are tied to the timeshare contract. Merely quitclaiming the deed does not absolve these responsibilities.

Contractual Agreement: Timeshares are not just real estate transactions but contractual agreements with the resort or management company. Transferring the deed via a quitclaim doesn’t mean the management company has to accept the new owner as fulfilling the obligations of the original contract.

Lack of Due Diligence: A quitclaim deed merely transfers whatever ownership interest the grantor has and does not provide any guarantees or warranties about the property. This can be risky for the grantee, who may not understand what they are assuming.

Credit Impact: Failing to meet the financial obligations of the timeshare after transferring it via quitclaim deed could negatively impact your credit score.

Legal Risks: If the new grantee defaults on the maintenance fees or loans, the timeshare company could take legal action against both the new and original owners.

Consent of Management Company: Many timeshare contracts require the consent of the management company to transfer ownership. Bypassing this requirement could be a breach of contract.

Tax Consequences: Depending on how the transaction is structured, there might be tax implications for the original owner.

Given these complexities, if you’re considering exiting your timeshare, consult with our attorney at Law Office of Elena Vlady, PLLC, to explore the most appropriate options for your situation.

Legal timeshare cancellation is easier than it used to be. Many resorts have opened “take-back” or “deed back” programs that allow distressed timeshare owners to give their timeshare back to the resort developer. These programs are not available to all, but they are a good start.

Many timeshare resort developers will only allow owners to give back their timeshare if it is paid in full and current on maintenance fees. Some developers won’t allow you to give back your timeshare unless you can prove financial or medical hardship. The following timeshare resort developers have offered a “deed back” or “take back” program according to the American Resort Development Association (ARDA):

- Capital Vacations®

- Club Wyndham®

- Diamond Resorts®

- Hilton Grand Vacations®

- Holiday Inn Club Vacations® (IHG®)

- Orange Lake®

- Hyatt Residence Club®

- Margaritta Vacation Club by Wyndham®

- Marriott Vacation Club®

- Shell Vacation Club®

- Sheraton Vacation Club®

- Bluegreen Vacations®

- Vistana Signature Experiences®

- Welk Resorts®

- Westgate Resorts®

- Westin Vacation Club®

- WorldMark by Wyndham®

Wyndham® and WorldMark® is one of the largest timeshare developers in existence. The company was one of the first timeshare developers to develop its own robust timeshare exit program. Its first exit program was called Ovation by Wyndham®, but now the company is referring to the process of canceling Wyndham® timeshare by “Certified Exit – backed by Wyndham™”. We are unsure what led to the name change, but glad to see an exit option still exists.

Unlike other timeshare developers, Wyndham may be able to help you sell Wyndham® or WorldMark® timeshare with a reputable timeshare resale broker. This is great news because it could mean that instead of paying to get out of Wyndham® timeshare, you might actually get something back for it. You likely won’t get much, but selling with a reputable timeshare resale broker that doesn’t charge up front fees is always a better option than working with a timeshare exit company or getting lawyers involved.

Diamond Resorts® is another large timeshare developer that was one of the first to offer an exit program for its owners. Diamond’s exit program is called Transitions™ by Diamond Resorts and it was announced in late 2017.

Diamond Resorts® is very transparent with its requirements for what owners must do in order to cancel Diamond timeshare. To start, the timeshare must be paid off with no loan balance or lien. The maintenance fees must also be paid and up to date as well. These requirements are common with almost all timeshare developer’s exit programs.

If you still owe a mortgage and don’t want to pay it off in order to qualify for Transitions™ by Diamond Resorts, an attorney may be able to help, especially if you felt you were lied to when purchasing the timeshare.

At the Law Office of Elena Vlady, PLLC, we can carefully review your timeshare contract and help you understand the terms and conditions before taking any action. If you’re not sure how to proceed or need a contract review, schedule a consultation with our attorney.